Information

- Digital licenses are delivered by email within 2-3 minutes of payment.

- Companies receive this software on account - even if only prepayment can be selected in the shopping cart.

- If you have more than one license, send us an inquiry - we will make an individual discounted offer.

- Supports all client Windows versions from Windows 7 - including 8, 9, 10 and 11

- Supports server operating system versions from Windows 2008 R2 - Net Framework required

- Download the demo version (click)

VAT Validator (PC/Windows) - UStID verification

Do you have sales tax numbers from your business partners and do not know whether these are valid ? This software validates these with a cross-check at the Federal Central Tax Office and logs these queries. With one click you can create reports for later verification. You have the burden of proof for an exam. Use this software and be on the safe side! Without proof, you can face repayment claims from the tax office.

What can the software do?

- checks the entered VAT ID number at the responsible Federal Central Tax Office

- calls an XML RPC interface of the Federal Tax Office

- also processes mass data - enter an Excel file and the software processes them all in sequence

- can be operated behind a proxy with and without single sign-on

- Search function for previously queried VAT IDs

- Report generation in a PDF document

- All interface responses are logged byte for byte in files

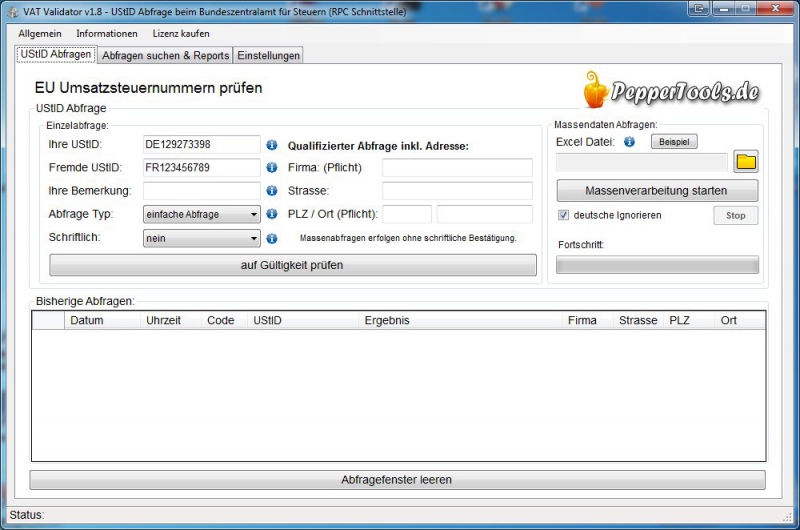

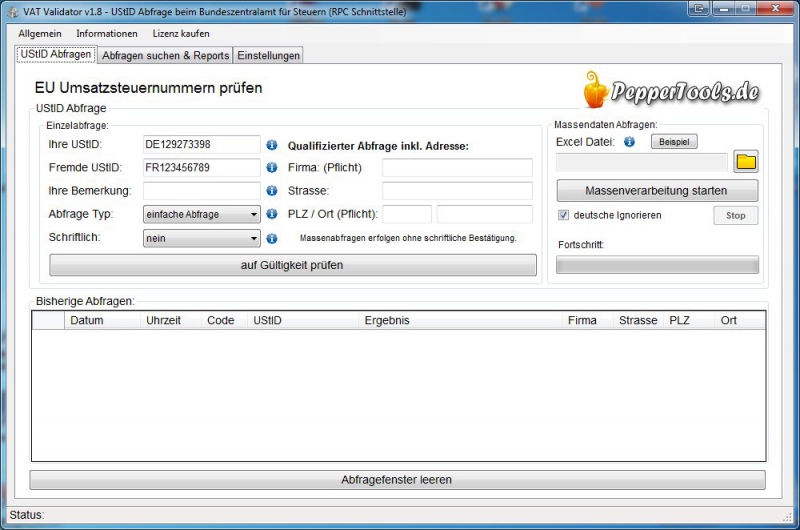

Query surface for manual queries without an Excel list

Enter your sales tax and sales tax number of the person you want to query. You can also choose between a simple and a qualified query. With the simple query, only the VAT number is validated. In the qualified query, the address data is also checked.

If you do not want to check the validity of the numbers individually, you have the option of uploading an Excel list which is then checked completely.

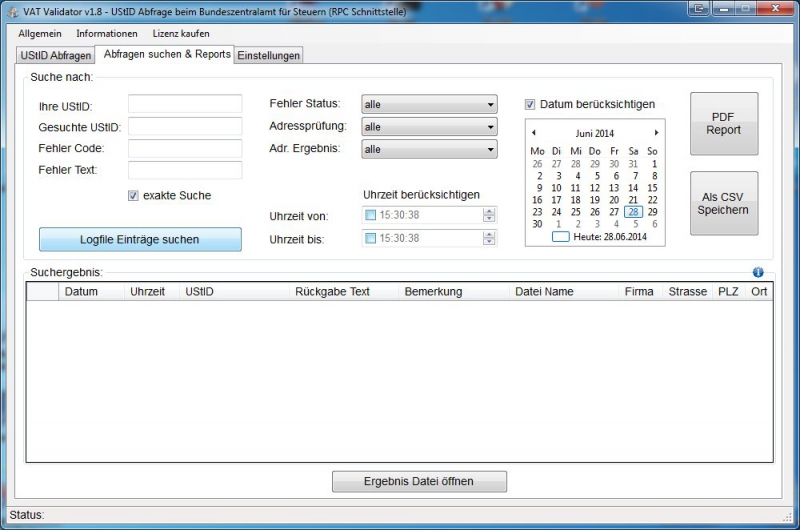

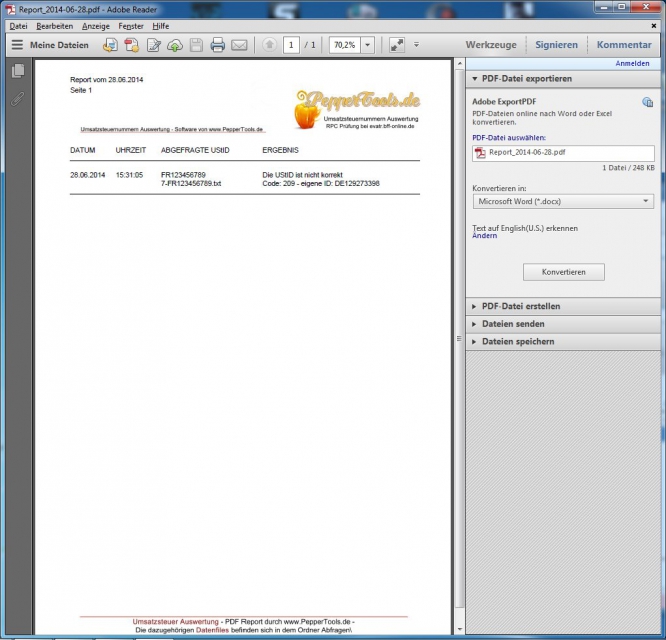

The results as a log file or PDF evaluation

You have the option to search for queries that have been made. These queries can be displayed with the result in the software. You can also export the results as a CSV or PDF file.

& nbsp;

PDF evaluations of the results

The results from the log file can be displayed in a PDF document. In this way you can save the results together. In addition, the original data traffic to the Federal Central Office is saved for each query so that you can prove the result perfectly.

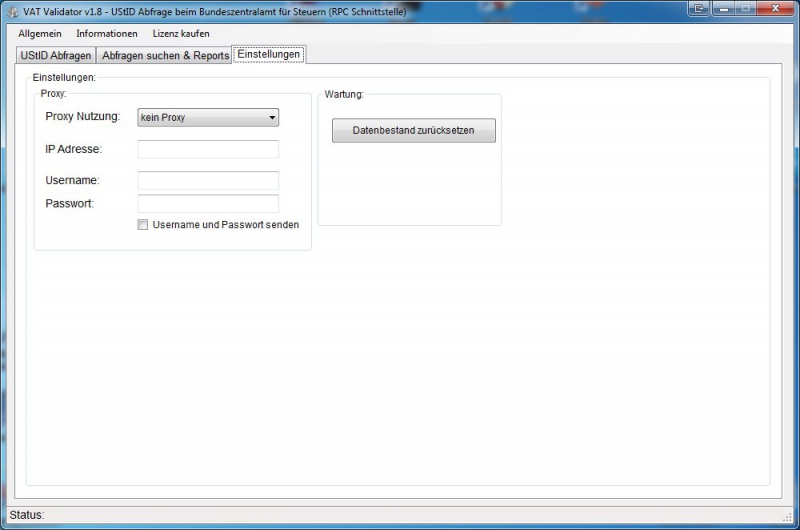

Proxy settings in company networks

If you use a proxy within your network, you can store this in the software.

Frequently asked questions

- What do I get delivered?

If you have a digital license, you will receive the license by email and a download link.

& nbsp; - Will the software be further developed?

The software has existed since 2014 and is constantly being further developed. Updates appear at regular intervals.

& nbsp; - Can I make suggestions for improvement?

We are always happy to include suggestions for improvement. These suggestions are always taken into account in the updates. The more the proposal brings all customers, the more likely it is that we will integrate it with an update

& nbsp; - Will I get updates

Yes. You can use the software to check in the Auto Updater whether there are any new updates and install them automatically. Updates are included in the annual license.

& nbsp; - What kind of license is that?

The license is valid for one PC. Several employees can work on this PC at different times - not at the same time. For terminal services where several employees connect, a license must be purchased for each employee.

File:

Software download - setup file - demo version | Full version

VAT Validator installation file. Download this file to install the program. You have the opportunity to test the program for free. By entering a license key, you make this program a full version. Saving receipts is not possible in the demo version.